what is a tax lot in real estate

According to Ascent Land Records a parcel number is a sequence of numbers andor letters mapping a real estate tax parcel to a legal description of a property or group of. The lot and block method is used to an extent in all states but is always used in conjunction with another form of land description such as metes-and-bounds.

Florida Property Tax H R Block

Value-added taxPercentage tax if the property to be sold is an ordinary asset.

. Tax Lot Accounting. A breakdown of all property within a given jurisdiction such as a city or county that can be taxed. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government.

Tax Class 2 Property Maps. Library of Tax Maps. Numerous and continuous sales over an extended time period are the hallmark of a real estate dealer.

Married filing separately over 258600. A lot is an individual piece of land which is intended to be conveyed in its entirety to a buyer. Creditable Withholding Tax for real properties sold by habitually engaged real estate sellers.

10 12 22 24 32 35 and 37. Personal Property Tax Vs. There are two basic categories of property.

The amount you deducted for. This is a tax paid in connection with the transfer of title to real property. The property at a tax deed sale is usually sold for the amount due in unpaid taxes plus fees and interest charges.

Just about every municipality enforces property taxes on residents using the revenue. Accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance and reporting. Types of personal property subject to.

The mention of a lien can send many. Property Map for Office Retail and Industrial Manhattan Bronx Brooklyn Queens Staten Island. The lien is the amount owed and must be paid in order for the sale or refinancing of the property to go through.

Manhattan Bronx Brooklyn Queens Staten Island. Tax Class 4 Property Maps. The tax roll will list each property separately in addition to.

Real property in general is land and anything permanently affixed to land eg. Real and Personal Property Overview. While real estate taxes cover only taxes on real property like a condo home or rental property personal property taxes include tangible and movable personal property including transportation vehicles like cars planes boats trailers or mobile homes.

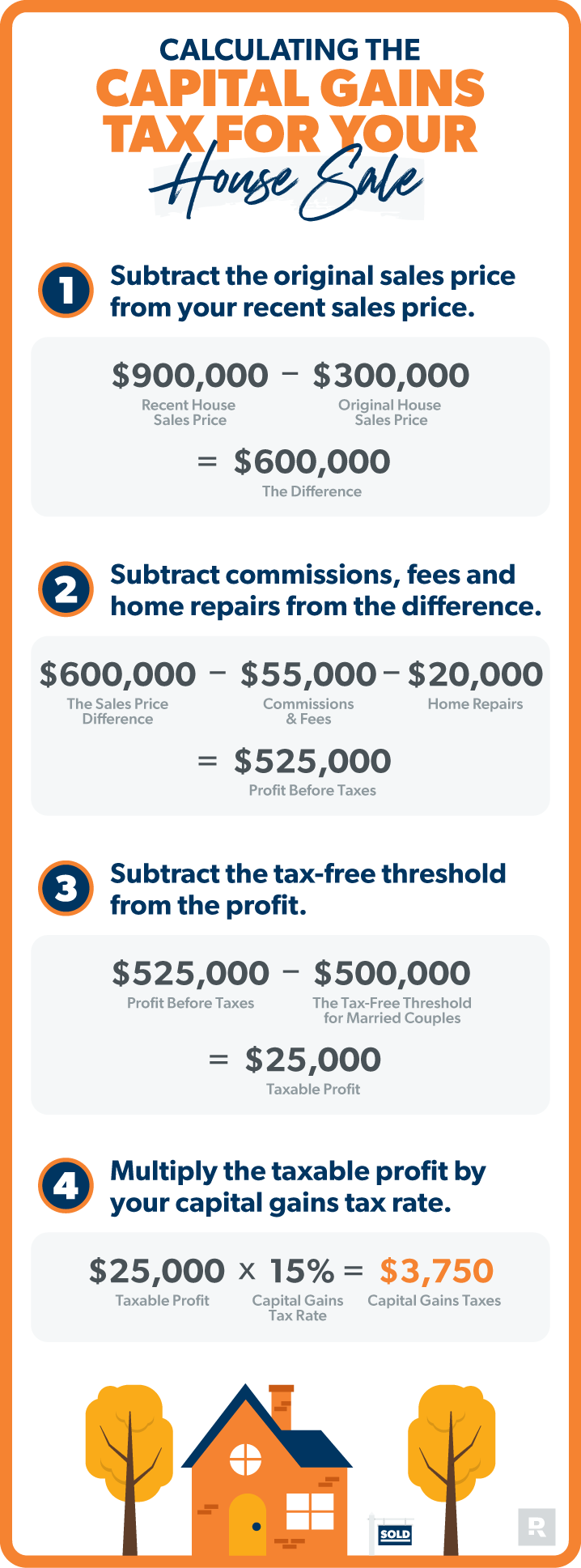

History of Tax Map Changes. It represents what you initially paid for your property including certain extra costs you incurred when buying the property like title insurance appraisal fees escrow fees lawyer fees document fees. Remember the short-term capital gains tax rate is the same as your income tax bracket.

Current income tax brackets for are. In fact many CPAs refer to it as Starting Basis. Other forms of tax debt can also lead to a tax lien on the property.

Accounting real estate US An parcel of real property on which. If your income is between these thresholds your capital gains tax rate is 15. Maps exclude properties in Class 1A 1C 2A 2B 2C.

But you pay at a maximum 25 percent rate on the first 100000. Its also known as a. A record keeping technique that traces the dates of purchase and sale cost basis and transaction size for each security in your portfolio even if you make more than one.

The real property tax rates in the Philippines are discussed in Section 233 of the Local Government Code of 1991. Capital gains taxes can apply to securities think stocks and bonds and tangible assets real estate. Head of household over 488500.

What Is a Property Tax Levy. Real estate developers say that without the tax abatement program or something similar it will be hard for them to finance the construction of new rental housing including affordable units. Digital Tax Map - New York City Department of Finance.

Cost Basis is the starting point. Either the buyer or seller can pay the tax depending on their mutual agreement. Property tax is the tax liability imposed on homeowners for owning real estate.

In some countries such as the USA cost basis must be considered on a tax lot -by- tax lot basis. When determining Cost Basis the. Structures such as homes apartments offices and.

A capital gains tax is the fee you pay on the profits made from selling an asset. The real property tax rate for Metro Manila Philippines is 2 of the assessed value of the property while the provincial rate is 1. Real estate dealers are entitled to the much the same deductions as any other business owner.

Counties may impose a documentary transfer tax at a rate of no more than 55 cents per 500 of the propertys value. Up to 25 cash back A good example is a subdivider who buys large tracts of vacant land divides them into smaller lots and then resells the lots piecemeal. The usual arrangement on which party pays what taxes in a sale transaction is as follows.

But several deductions can help lower your tax bill. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than. If youve depreciated the property you might pay a different rate.

A block is generally a group of contiguous lots bounded by streets such as a city block. For example if you buy a rental house at 300000 take depreciation deductions of 100000 over the years and then sell it for 320000 your gain for taxes is 120000. Income tax if the property to be sold is an ordinary asset.

The exact tax rates depend on the location of the property in the Philippines. As a real estate investor you pay taxes on real property income and capital gains. The assessment procedures and the tax rate will vary between these two categories.

Benefits Of Property Management Software For Realtors Infographic Property Management Management Real Estate Investing

Difference Between Real Estate Taxes And Property Taxes Difference Between

Pin By Anthony Welch On Passive Real Estate Decatur Real Estate Realty

Understanding California S Property Taxes

Property Tax How To Calculate Local Considerations

Difference Between Real Estate Taxes And Property Taxes Difference Between

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Best Tips For Lowering Your Property Tax Bill Property Tax Real Estate Education Real Estate

Deducting Property Taxes H R Block

Difference Between Real Estate Taxes And Property Taxes Difference Between

10 Tax Deductions For Real Estate Investors Real Estate Investor Real Estate Investing Getting Into Real Estate

How Property Taxes Are Calculated

What Is Section 1231 Gain Real Estate Sale Tax Advantages Picnic S Blog

Real Property Tax In The Philippines Important Faqs Lamudi

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Secured Property Taxes Treasurer Tax Collector

5 Most Overlooked Rental Property Tax Deductions Accidental Rental Rental Property Real Estate Rentals Rental Property Investment